TIN is an individual or business Taxpayer Identification Number

TIN ( Taxpayer Identification Number) is a unique eight-digit number used to identify an individual, business, or other entity in tax returns and other documents filed with the Tax Authority.

The Federal Inland Revenue Services (FIRS) and the Joint Tax Board(JTB) are.responsible for issuing the TIN

The FIRS is also responsible for assessing, collecting, and accounting for the money collected in taxes to the Nigerian government.

Why You Need To Get A TIN.

The first reason you need to get a TIN is because it is required by law.

All Nigerian individuals and companies that sell products or services are required by law to have a Taxpayer Identification Number (TIN). Same for persons that work for the government, other public entities, private companies, or freelance systems are required by law to have a TIN.

Other reasons why you need a TIN are that they are requirements for:

- Applying and obtaining a government loan.

- Must-have to open a business account.

- Obtaining an import, export or trade license.

- Vehicle registration .

- Getting tax clearance, allowance, waiver, or incentive.

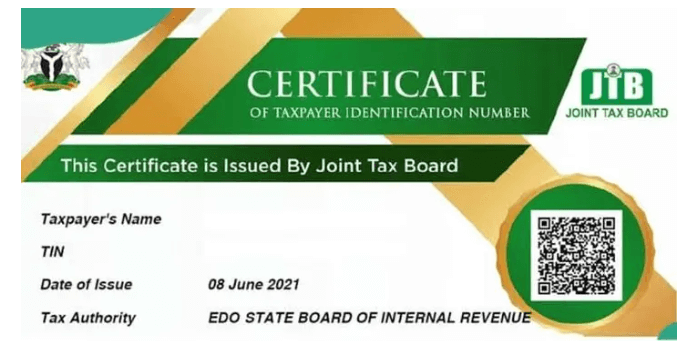

How To Verify TIN Online

After obtaining your TIN , it is important to verify the authenticity in the issued number.

You can verify your TIN using any of the following parameters:

1. Tax Identification Number (TIN)

2. CAC Registration Number

3. Phone Number.

To verify your Tin, follow these easy steps:

a) log onto the FIRS verification portal here:

b) Click on the ‘Select Search Criteria’ box

c) Select your preferred search criteria on the dropdown list ( i.e Tax Identification number, CAC registration number, or phone number.

d) check the correct reCAPTCHA image boxes

e) click on the search button

If you do not have a TIN yet, you can apply on the JTB (Joint Tax Board) website here

Click on “Registration for TIN” (individual) or (non individual if registration is for an organization).

You will need your NIN or BVN (Bank Verification Number). for individual registration or Business name and registration number for organizations .

You can also visit the nearest Federal Inland Revenue Service (FIRS) office with;

- a copy of a recent Utility Bill,

- a Valid ID (Government Approved) and

- a Passport Photograph.

Conclusion

Having a TIN is a necessity for every Nigerian citizen and also as organizations operating within the country.

The TIN empowers financial inclusion, business formalisation and operational efficiency.